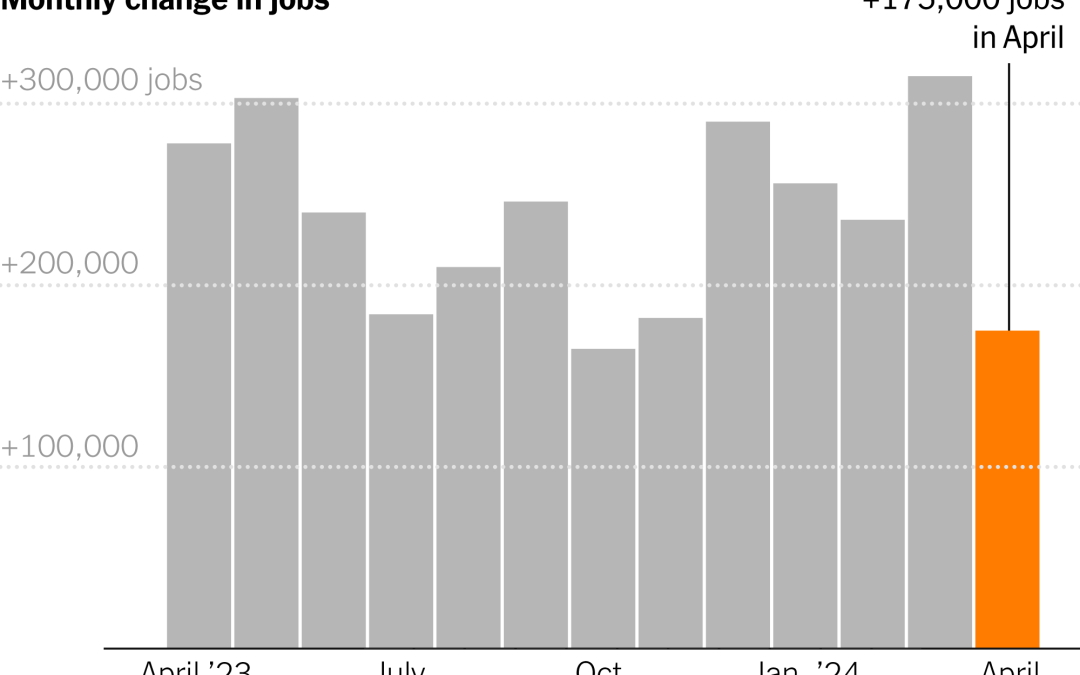

April’s jobs report landed with a thud — only 175,000 jobs were added, pointing to a distinct cooling off from the sizzling pace we’ve seen in recent months. The numbers are more than just digits on a page; they are a harbinger, whispering tales of economic shifts and the Federal Reserve’s looming decisions on interest rates.

What’s Behind the Slowdown?

The narrative of this month’s job growth is a complex one, influenced by a myriad of factors that seem to be pulling the economy in several directions at once. Analysts and economists are looking at several potential culprits:

- Sector-specific slowdowns: Some industries have hit a soft patch, reducing their pace of hiring. This is particularly visible in sectors like manufacturing and retail, which are traditionally sensitive to economic ebbs and flows.

- Global economic pressures: From rising oil prices to fluctuating markets abroad, international pressures are no doubt playing a role in domestic job figures.

- Cyclical economic trends: The economy might be entering a phase of slower growth, which is typical after periods of rapid expansion.

Amid these discussions, one thing is clear — the job market is no longer on the turbo-charged path it had been. The shift is subtle yet undeniable, painting a picture of an economy that’s downshifting gears as it approaches uncertain terrain.

The Ripple Effects

This slowdown isn’t just a number. It ripples across various aspects of economic life:

- Consumer confidence: With fewer jobs being added, households might tighten their belts, anticipating tougher times.

- Business planning: Companies may revise their growth strategies, postpone expansion plans, and become more cautious with investments.

- Policy implications: The Federal Reserve keeps a keen eye on job growth as a key indicator for their monetary policy decisions. Slower job growth could influence their approach to interest rates, potentially easing up on hikes to avoid stifling economic growth.

April’s job report serves as a reality check for those tracking the pulse of the U.S. economy. It reflects the nuanced challenges and opportunities that lie ahead, reminding us that the path to economic resilience is rarely a straight line. As we digest these numbers, the bigger picture begins to emerge — one of an economy that’s perhaps moving towards a more sustainable, though slower, pace of growth.

Examining the Impact on Workers and Wages

How the Slowdown Affects the Labor Force

This moderation in job creation has a tangible impact on the workforce and their paychecks. April’s subtle shift sends ripples through the lives of millions, influencing everything from wage dynamics to job security.

- Wage growth: Historically, a tight labor market leads to higher wages as employers compete for a limited pool of talent. But as job growth cools, this upward pressure on wages might stall. While wages are still rising, the pace might not sustain if job additions don’t pick up.

- Job security: Workers may start feeling the ground beneath them shift. Industries that were once on hiring sprees could hit pause, creating an atmosphere of uncertainty. This is especially true for sectors that are directly impacted by economic swings, like construction and manufacturing.

Despite these concerns, there are also opportunities hidden within these shifts. Some sectors, particularly technology and healthcare, continue to show resilience and demand for skilled workers. This divergence highlights the economy’s complex and multifaceted nature, where some areas slow down while others remain robust.

The Federal Reserve’s Balancing Act

The Fed has its work cut out, balancing between sustaining growth and controlling inflation. With job growth slowing, the path forward becomes even trickier. The central bank might see this as a sign to hold off on aggressive rate hikes to avoid tipping the economy into a recession. It’s a delicate balance — one that requires nimble responses to evolving economic indicators.

This cooling phase in the job market is not just a statistic. It’s a shift that could redefine the economic landscape, prompting both policymakers and businesses to rethink their strategies. As we move forward, the true test will be in how these entities adapt to maintain stability while fostering growth in a changing economic environment.

Strategies for Economic Recovery and Adaptation

Economic Strategies and Business Responses

As the job market shows signs of slowing, businesses and policymakers are brainstorming strategies to boost economic resilience. The focus now shifts from rapid expansion to sustainable growth, with several key strategies taking center stage:

- Encouraging Entrepreneurship and Innovation: Small businesses and startups are often touted as the backbone of the economy. Encouraging innovation can lead to new job opportunities, especially in emerging industries that could be less sensitive to traditional economic downturns.

- Investment in Infrastructure: Significant investment in infrastructure not only creates jobs but also improves efficiency and productivity for various sectors. This can stimulate further economic activity and employment opportunities.

- Upskilling and Reskilling Workforces: As certain sectors slow, there is a growing need to train workers in skills that are in demand, particularly in technology and green energy sectors. This strategy helps prevent long-term unemployment and keeps the workforce adaptable.

These strategies are not just stopgaps but are intended to foster a more robust economic environment that can withstand global pressures and internal shifts.

Looking Ahead: The Role of Government Policy

The government plays a crucial role in shaping the economic landscape. With the current job market slowdown, the pressure increases on policymakers to enact measures that stimulate job growth without leading to overheating. This involves:

- Tax Incentives: Offering tax breaks or incentives for businesses that hire additional staff or invest in training can help stimulate employment.

- Monetary Policy Adjustments: The Federal Reserve might consider easing up on interest rate hikes if the job growth continues to falter, to keep money flowing through the economy.

As we look forward, it’s clear that the interplay between government action, business innovation, and workforce development will be critical. The road to recovery and sustained economic growth is a multifaceted one, requiring cooperation across all sectors of the economy. This phase might be challenging, but it also presents an opportunity to build a more durable economic foundation for the future.

Perspectives and Predictions: Navigating an Uncertain Future

Insights and Projections from Economic Experts

The economic landscape is shifting — and with it, the predictions and insights from leading economists take on new significance. As job growth stalls, these experts weigh in on potential scenarios and strategic moves:

- Modest Recovery Predictions: Some economists suggest that job growth might rebound modestly in the coming months if consumer spending holds up and businesses continue to adapt. This rebound depends largely on external economic pressures easing, including trade relations and global market stability.

- Risk of Recession: There’s a palpable concern about a potential recession. While not all agree on the immediacy or severity of such a downturn, the slower job growth rates are making the possibility harder to ignore. A downturn could be mild but might last longer than usual due to persistent global uncertainties.

The Public and Private Sectors: A Unified Front

The path forward is likely to require a unified response from both public and private sectors. Collaboration will be essential in fostering an environment conducive to job creation and economic stability:

- Public Sector Initiatives: Government policies could focus on enhancing employment benefits to provide a safety net for those affected by job market fluctuations. Additionally, further investment in public projects could stimulate job creation directly.

- Private Sector Adaptations: Businesses might need to pivot towards more sustainable practices, focusing on sectors that promise growth, such as green energy and digital technologies. This pivot not only aligns with global trends but also addresses consumer demand for more responsible business practices.

The slowdown in job growth is a wake-up call, reminding us that economic stability is never a given. It requires careful management, foresight, and sometimes, a bit of courage to steer through turbulent waters. As we look ahead, the resilience of the U.S. economy — bolstered by strategic decisions and collaborative efforts — will be tested. The outcome will likely define the economic narrative for years to come.

Conclusion: Resilience and Adaptability in Economic Strategy

As we digest the news of the U.S. adding just 175,000 jobs in April, the figures prompt a broader discussion about the resilience and adaptability of the economy. This slowdown isn’t just a statistical blip — it’s a signal that could influence economic strategies from the highest levels of government to the smallest businesses.

The current shift in job growth underscores the need for agility in economic planning and policy making. It also highlights the importance of being prepared for changes that may not always be predictable. Here’s what we should keep in mind:

- Adaptability is Key: Businesses and workers alike must remain flexible, ready to pivot towards new opportunities as traditional sectors fluctuate.

- Policy Makers’ Role: It is crucial for economic policies to support a robust job market while also ensuring that the foundations are laid for sustainable growth.

- Future Uncertainties: While today’s job market may seem challenging, it is also filled with opportunities for those ready to adapt and innovate.

This phase of the U.S. economy, marked by a slowdown in job growth, offers a chance to pause and reassess — to build a more resilient economy that is prepared for whatever lies ahead. Despite the current slowdown, the overall strength and resilience of the U.S. economy give us reason to be optimistic. By embracing change and focusing on sustainable growth, we can navigate through uncertainties and emerge stronger on the other side.